Enhancing corporate governance

Basic approach

We, at the MIRAIT ONE Corporation, recognize the importance of management as a socially-responsible company and have put in place organizational structures and systems to ensure transparency and fairness in decision-making. Building relationships founded in trust with all of our stakeholders including shareholders is positioned as the most important aspect of management.

We consider the realization of effective corporate governance is indispensable for building trust relationship with stakeholders.

Therefore, we

- Protect shareholder rights and equality among shareholders,

- Collaborate with stakeholders other than shareholders in appropriate ways,

- Disclose information in appropriate ways and secure transparency;

- Deliver on responsibilities, especially that of the board of directors, and

- Engage with shareholders to improve the effectiveness of corporate governance.

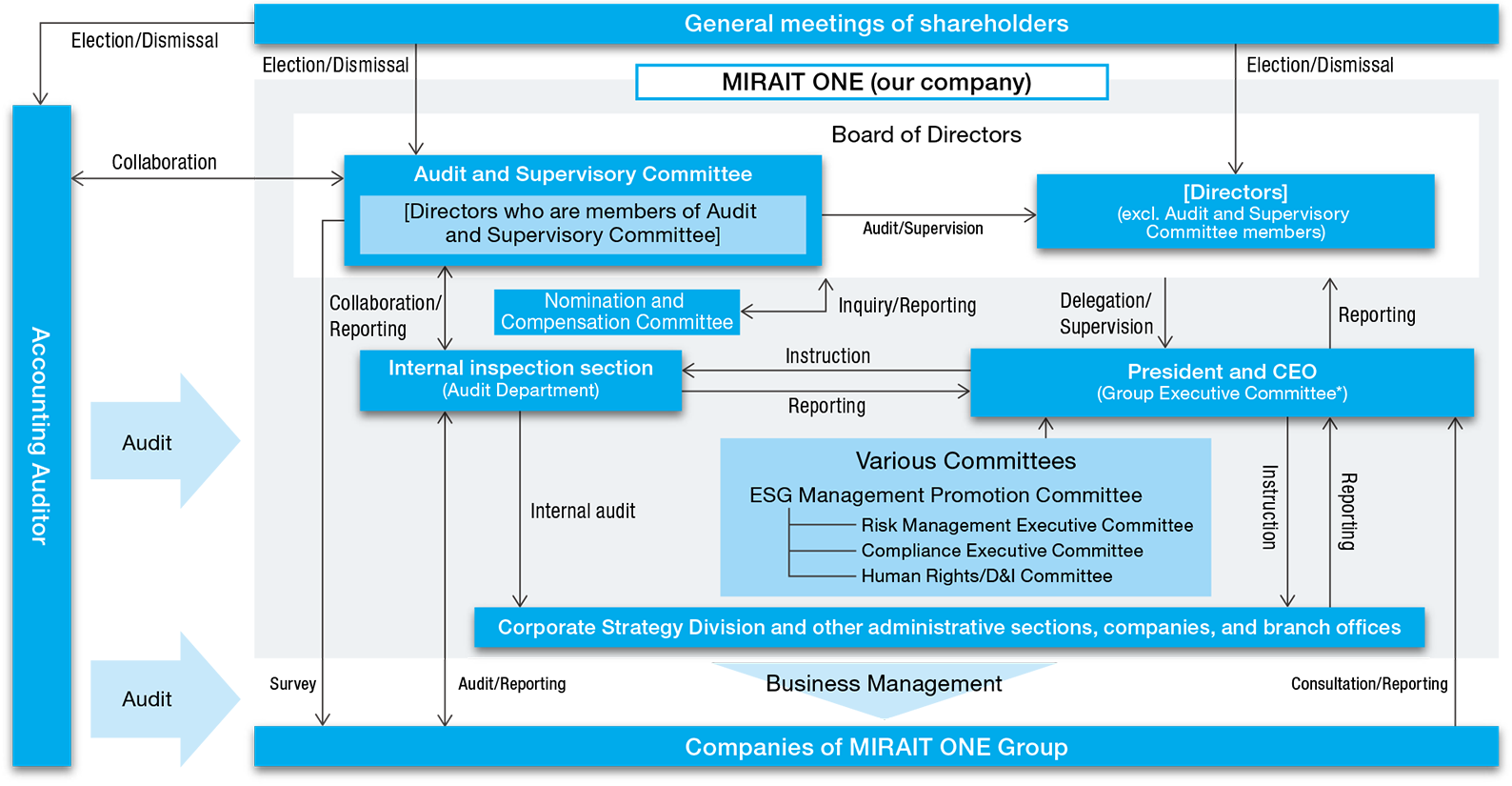

Governance Structure

We are a company with an Audit and Supervisory Committee, overseen by a board of directors, an audit and supervisory committee, and accounting auditors.

We have set up a system for reciprocal cooperation where the Audit and Supervisory Committee together with an internal audit section and accounting auditors each perform independent inspections.

Also, we are working to improve the corporate value by strengthening the governance and the internal audit structure based on the policy of three-lines of defense, strengthening corporate governance through tight liaison of the Audit and Supervisory Committee and the internal audit section, improving healthiness and transparency of management, and making quick decisions.

Governance Structure

*Effective July 1, 2024, the Group Presidents' Council and the Executive Committee were integrated into the Group Executive Committee.

*Effective July 1, 2024, the Group Presidents' Council and the Executive Committee were integrated into the Group Executive Committee.

Policy and Procedures for the Nomination of Candidates for the Board of Directors

In the nomination process of candidates for the board of directors, the MIRAIT One Corporation selects a wide variety of candidates from both inside and outside of the company, consults with the Nomination and Compensation Committee chaired by an independent outside director, and determines the candidates who have excellent personalities, superior insights and high managerial capabilities, at the board of directors meetings based on the replies from the Committee.

* The rationale for selection of each director is outlined in the notice of general meeting of shareholders.

Effective use of outside directors

For outside directors, we appoint individuals who have abundant experience and knowledge across different fields who can perform their roles and duties with a specialized and objective viewpoint by providing guidance and management oversight from the perspective of enhancing the Company’s medium- to long-term corporate value. For independent outside directors who serve on the Audit and Supervisory Committee, we appoint those who have abundant experience and knowledge across different fields and who can properly supervise the Board of Directors’ managerial decisions, execution of duties, and compliance with laws and regulations with independent and objective views, thereby enhancing the transparency of the Board of Directors and serving greater corporate value.

Outside directors attend meetings, including Board of Directors meetings, to understand the Group’s management issues.

In addition, they offer their opinions from their respective professional and objective viewpoints as needed, and strive to ensure transparency and efficiency in management by exchanging views with other directors.

* The criteria for determining the independence of outside directors of the Company and the status of their activities are provided in the “Corporate Governance Report” and other documents.

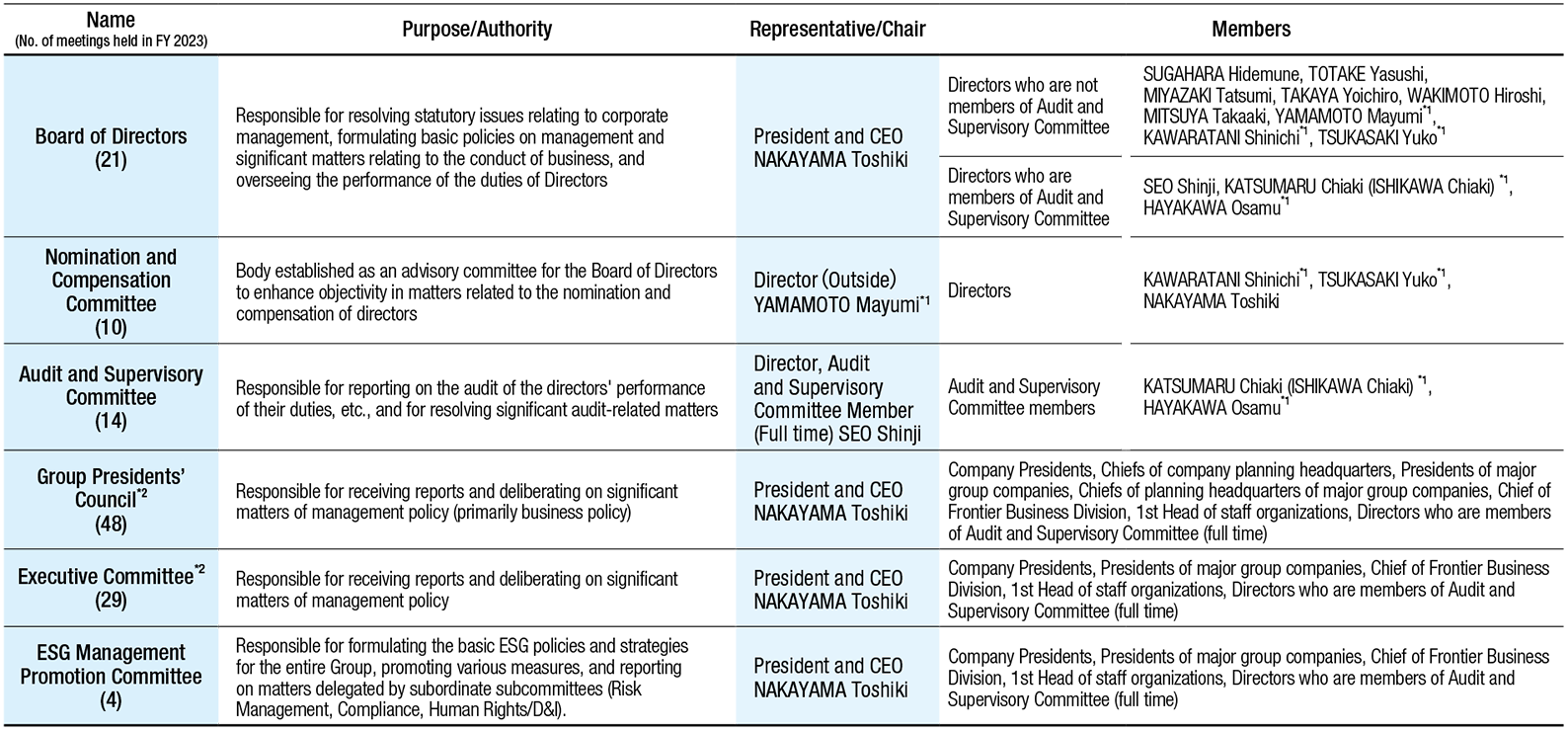

Overview of Established Corporate Bodies

*1 Directors YAMAMOTO Mayumi, KAWARATANI Shinichi, TSUKASAKI Yuko, KATSUMARU Chiaki (ISHIKAWA Chiaki), HAYAKAWA Osamu are outside directors.

*1 Directors YAMAMOTO Mayumi, KAWARATANI Shinichi, TSUKASAKI Yuko, KATSUMARU Chiaki (ISHIKAWA Chiaki), HAYAKAWA Osamu are outside directors.*2 The Group Presidents' Council and the Executive Committee were integrated into the Group Executive Committee as of July 1, 2024.

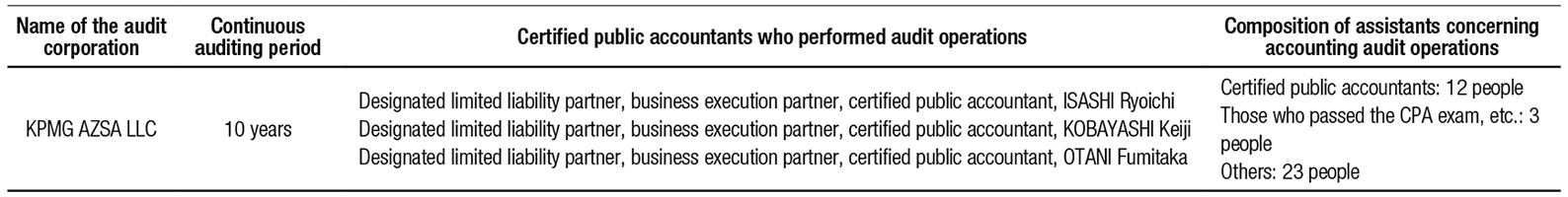

Status of Accounting Auditor

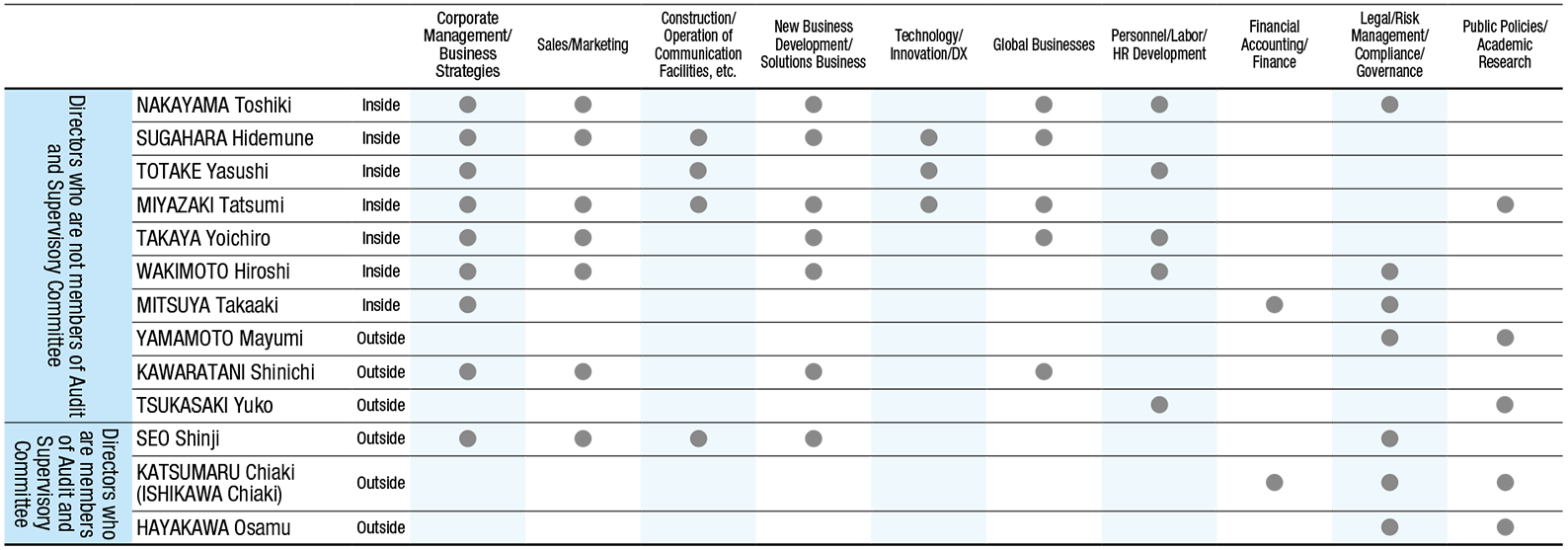

Skills Matrix for Directors

Definition of the Primary Areas of Experience and Expertise (Skills) of Directors

Board Structure that Balances Diversity in Gender, Internationality, etc. and Appropriate Size

As a business holding company that oversees various business fields, the Company ensures that the composition of the Board of Directors is well-balanced by appointing individuals with a wealth of experience and superior knowledge in various specialized fields, such as business strategy, international strategy, finance, and personnel affairs.

In addition, the Company aims to ensure transparency and enhance corporate value by having individuals with many years of practical experience in corporate management, experts in corporate legal affairs and finance, and academic experts join the Board of Directors as outside directors and provide an outside perspective.

As for the size of the Board of Directors, we have achieved greater effectiveness and efficiency by functioning sufficiently as a business holding company while at the same time having some board members who also serve as directors of core Group companies.

The Company has appointed four women executive officers: two directors who are not members of Audit and Supervisory Committee, one director who is a member of Audit and Supervisory Committee and one executive officer.

The expertise and experience (skills) required of directors, as well as their details, are as shown in the above “Skills Matrix for Directors” and “Definition of the Primary Areas of Experience and Expertise (Skills) of Directors.”

Efforts to Ensure the Efficient Execution of Duties by Directors

In accordance with the Regulations of the Board of Directors, Board of Directors meetings are held once a month and as needed, and 21 meetings were held during FY 2023. The Board of Directors meetings deliberate on all matters to be discussed at the Board of Directors meetings in accordance with the internal regulations, and actively exchange opinions on each matter, as well as receive quarterly reports on the status of execution of duties by each director.

In addition, the Board of Directors is evaluated for its effectiveness to improve its functioning.

Also, in light of the Corporate Governance Code, the “Nomination and Compensation Committee,” a voluntary advisory committee, was established under the Board of Directors to enhance the objectivity of nomination and compensation. The Committee met 10 times during FY 2023.

Independent outside directors hold regular meetings with representative directors to strengthen the monitoring function for the execution of duties by directors.

Efforts to Ensure the Effective Implementation of Audit and Supervisory Committee Member

In addition to inspecting important decision-making documents,Audit and Supervisory Committee Members attend significant meetings including Group Executive Committee meetings to gain an understanding of the company’s important decision-making process and the status of business execution.

In addition, Audit and Supervisory Committee Members, representative directors, the Accounting Auditor, and others communicate with each other and exchange opinions to ensure that the audits by Audit and Supervisory Committee Members are conducted effectively.

The Company has established the Audit and Supervisory Committee Office with full-time staff to assist the Audit and Supervisory Committee in its duties, and three individuals have been assigned to this office.

Appraisal of the Effectiveness of the Board of Directors

At the Board of Directors meetings, we check the execution of duties by directors, including the state of compliance with laws and regulations, the state of risk management and information sharing, and the speed with which issues are resolved, and we also strive to ensure the effectiveness of the Board of Directors as a whole by holding meetings between representative directors and outside directors.

In addition, once a year, all directors are subject to a self-assessment of the effectiveness of the Board of Directors with the aim of improving the functioning of the Board of Directors as a whole and sharing awareness of the direction in which our corporate governance is headed.

More specifically, the self-assessment is conducted through an anonymous questionnaire to ensure that candid opinions are heard, and the questionnaire consists of major assessment items asking about the structure, operational status, responsibility and functions of the Board of Directors and the state of the Board of Directors as seen from outside directors. As for collecting responses, they are collected by an external law office with a duty of confidentiality, and they are analyzed by a third-party organization. Based on the results of this analysis, our Board of Directors has verified and evaluated the current situation and obtained favorable results, and continues to discuss issues related to the Board of Directors.

[Overview of the Effectiveness Assessment Made in FY 2022 and Results of Measures Taken]

[Major opinions]

In order to facilitate more substantive discussions aimed at increasing corporate value over the medium to long term, the Management Executive Committee needs to explore specific issues related to identifying issues at stake, sharing information, narrowing the agenda, securing time for deliberation, and delegating the execution of business execution.

↓

[Measures Having Been Taken]

Prior to deliberations at Board meetings, the Company actively worked to intensify discussions at Board meetings by providing additional opportunities for preliminary briefings and exchanges of views with representative directors, in addition to the existing “Deliberative Forum”.

[Overview of the Effectiveness Assessment for FY 2023]

[Major opinions]

There is a need for more constructive discussions on matters related to the composition of the Board of Directors and the appointment/dismissal of directors, as well as on medium- to long-term management direction. Specific consideration is also needed regarding the delegation of important business execution.

↓

[Measures Being Taken]

Regarding matters related to the composition of the Board of Directors and the appointment/dismissal of executive officers, we held repeated discussions on streamlining the Board structure in forums such as the Nomination and Compensation Committee, and implemented the resulting measures. Additionally, for medium to long-term group management strategies and delegation of important business execution, we are further deepening discussions of the Board of Directors through debates in “Deliberative Forum,” where Board members can freely exchange opinions. We are continuously working to maintain and improve effectiveness through these efforts.execution.

Training of Directors

The Company has established a systematic and regular series of executive seminars for directors and executive officers of the MIRAIT ONE Group. These seminars serve multiple purposes, including: (1) instilling and strengthening basic management skills appropriate for a prime market company; (2) providing opportunities to develop a comprehensive understanding of the market, technology and global trends including global conditions; and (3) aligning the direction of the directors and executives.

In addition, outside directors and others are provided with opportunities including inspections of business establishments of operating companies and construction sites, as appropriate, so that they can deepen their understanding of our business content and current conditions.

Planning and Development of Successors for the CEO, etc.

Regarding succession planning and development for the CEO and other senior executive positions, from the perspective of ensuring transparency and fairness in company decision-making and enhancing corporate governance more effectively, we formulated a “Succession Plan for Directors (including Representative Directors)” at the Board of Directors meeting held on April 26, 2024.

This plan is being appropriately implemented in line with our management philosophy and business strategy. For the appointment of the CEO, the Nomination and Compensation Committee, chaired by an independent outside director, is consulted, and the Board of Directors votes on the appoint-ment based on the report of the Nomination and Compensation Committee.

Compensation, etc. of Executive Officers

Basic Policy

With regard to the compensation of directors (excluding the directors who are Audit and Supervisory Committee Members. The same applies below), the total amount (limit) is set by the General Meetings of Shareholders after approval by the Board of Directors, and each director receives compensation in accordance with their roles and responsibilities.

As well, with regard to the policy for deciding the compensation for each director, for the purpose of enhancing objectivity and transparency, the “Nomination and Compensation Committee” (chaired by an independent outside director), which is an advisory body to the Board of Directors and consists of four independent outside directors and the President and CEO, reports the results of its deliberations to the Board of Directors, which then makes decisions based on the report.

Outside directors, who are responsible for supervisory functions, are paid only monthly basic compensation in light of their duties.

* Details of compensation for executive officers are provided in the “Annual Securities Report.”

Introduction of Performance-linked Compensation System

We have introduced the “Board Benefit Trust,” a performance-linked stock compensation system, for the purpose of clarifying the linkage between the compensation of executive officers and the Company’s business performance and stock value, and heightening awareness about contributions to the improvement in the business performance and corporate value over the medium to long term.

As for the indicators for performance-linked compensation, the Company has chosen the degree of achievement in areas such as the “consolidated operating income,” “ROE,” and “ESG indices.” These metrics were selected for their ease of understanding and are designed to raise awareness of one's contribution to improving the Group's consolidated performance and corporate value. A benchmark was established by allocating 30% of the monthly compensation for a period of three months in accordance with the “Internal regulations on issuing shares to executives.” Under the point system, the number of points is calculated by multiplying the performance-linked coefficient determined by the level of achievement of the Company's “consolidated operating income,” “ROE” and “ESG Indices.” Upon retirement, one share is granted for each point earned.

Also, in FY 2022, the Company introduced the “GHG reduction target” into the set of indexes for performance-linked compensation as a consolidated ESG index to raise awareness of ESG initiatives among management personnel.

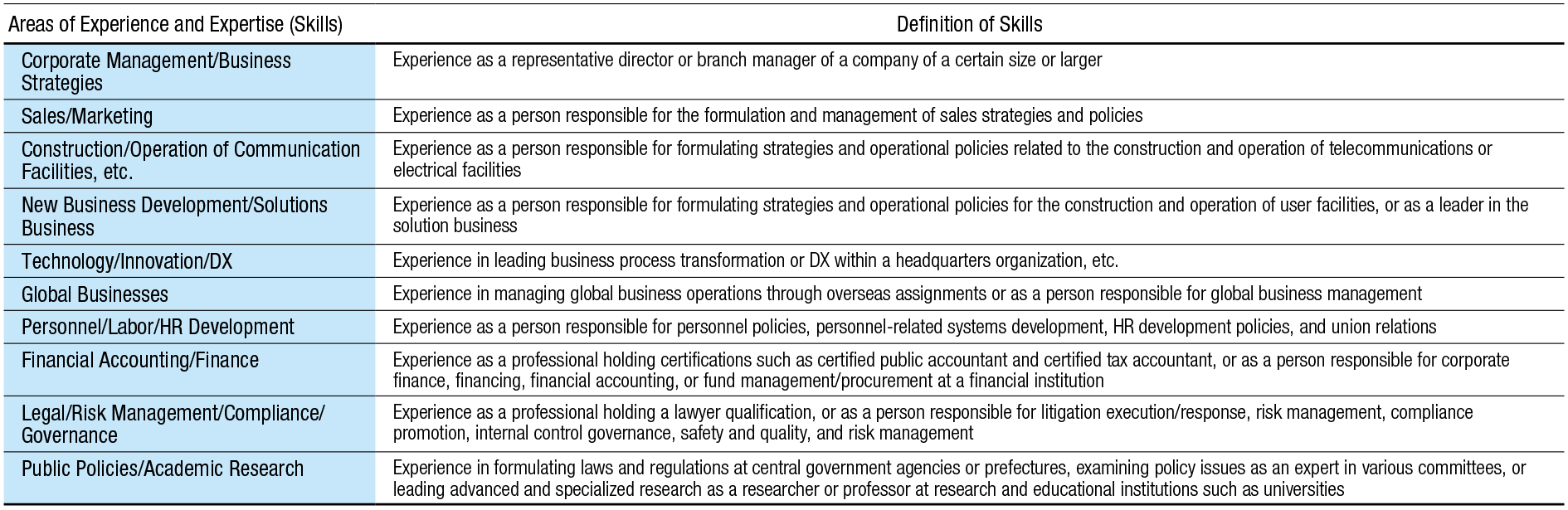

Percentage of the Amount of Monetary Compensation and the Amount of Performance-linked Compensation, etc.

* In consideration of insider trading regulations, etc., and in order to heighten management awareness and the common goal of increasing shareholder value, directors (excluding outside directors) are required to contribute at least 10% of their monthly compensation to the Executive Officers’ Stock Option Plan, which effectively changes the percentages: 72% for fixed compensation, 28% for variable compensation, and 14% for non-monetary compensation (stock-based compensation).

Matters Concerning Delegation of Authority for Determining Compensation, etc. of Individual Directors

For FY 2023, it has been resolved that the decision on the amount of basic compensation for each director and the amount of bonuses based on the business performance of each fiscal year would be left to President and CEO NAKAYAMA Toshiki, assuming that the Nomination and Compensation Committee would be consulted within the range of the total amount approved at the General Meeting of Shareholders, based on the resolution of the Board of Directors on June 27, 2023. The reason for delegating these authorities is that the President and CEO is considered to be the most suitable person to evaluate the execution of duties by each director while having a bird’s eye view of the company’s overall business.

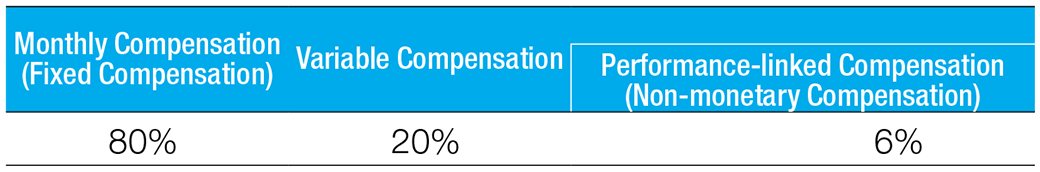

Total Amount of Compensation for Each Executive Class, Total Amount of Compensation by Type, and the Number of Eligible Executive Officers

Total Amount of Consolidated Compensation, etc. for Each Executive Officer

This information is not provided because no executive officer received a total of 100 million yen or more in consolidated compensation, etc.

Transactions with Related Parties

We require that competitive transactions and conflict-of-interest transactions conducted by directors be deliberated and approved by the Board of Directors, and that the status of such transactions be reported to the Board of Directors on a regular basis.

We require executive officers to submit a “Related Party Confirmation Statement” to ascertain whether there are any transactions with related parties, such as themselves, their close relatives, organizations they represent, and organizations in which they hold majority voting rights.

With regard to transactions with major shareholders, in accordance with internal regulations, the person with decision-making authority is required to confirm the appropriateness of such transactions to ensure that they do not harm the Company or the common interests of shareholders, and report particularly important transactions to the Board of Directors.

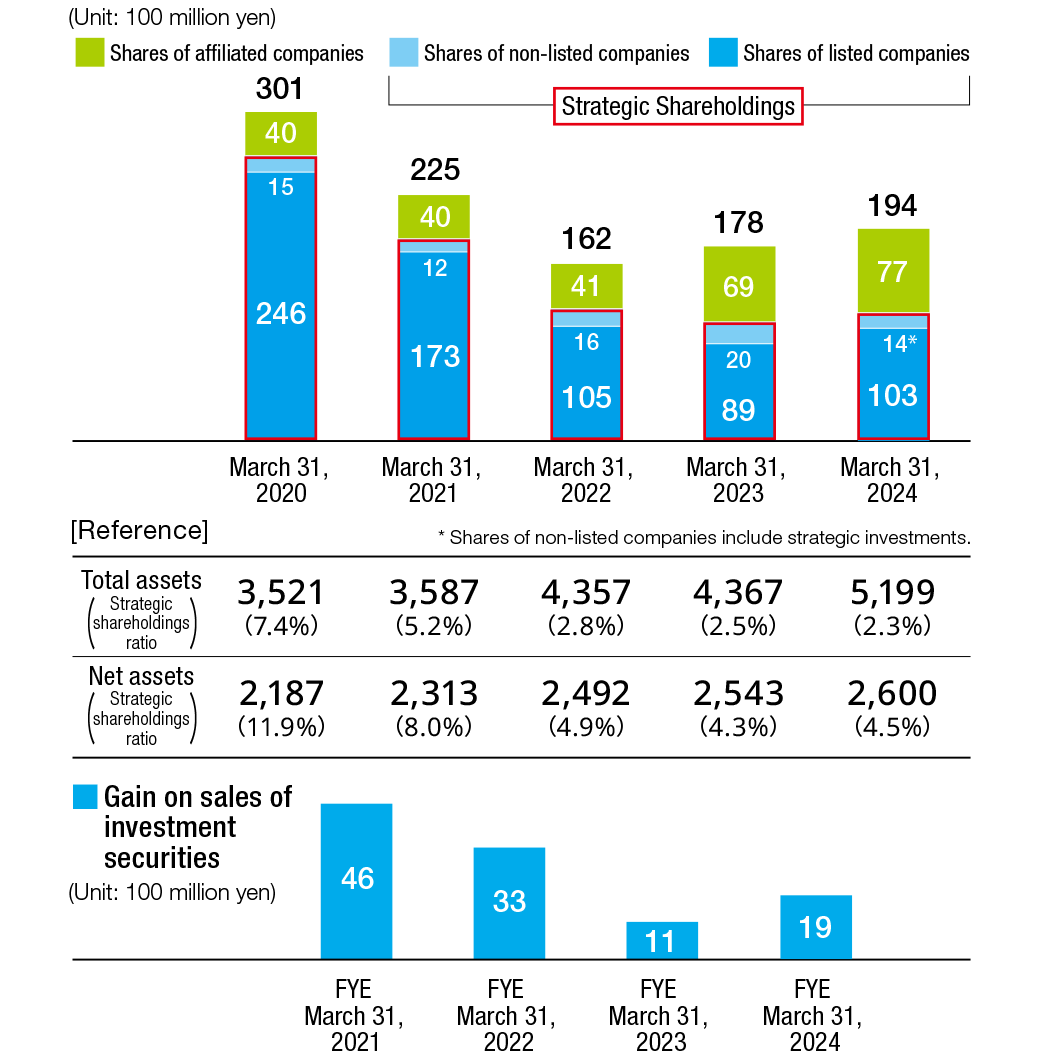

Strategic Shareholdings

Criteria and Concepts for Classification of Investment Shares

Our group classifies shares that it holds for the following purposes as strategic shareholdings.

A. Maintaining and strengthening business relationships with the investee company

B. Maintaining and strengthening cooperative relationships to promote alliance business

C. Cooperating for efficient construction, etc.

Shares held for other purposes are classified as investment shares for pure investment purposes.

Strategic shareholdings policy, method of verifying the rationality of shareholding, and details of the Board of Directors' verification regarding the appropriateness of holding individual issues

A. Holding policy Our group holds shares of its business partners when it believes that holding such shares will enhance the Group’s corporate value and benefit its shareholders. After reviewing the purpose of holding shares and the status of transactions, etc., if the holding of such shares is deemed to be of little significance through quantitative and qualitative verification, we will gradually reduce the holdings through divestment, etc.

B. Methods of verifying the rationality of shareholding The Company conducts quantitative and qualitative review of strategic shareholdings in terms of medium- to long-term economic rationality and future prospects based on return and risk, etc.

C. Details of review by the Board of Directors, etc. as to whether or not to hold individual issues

Changes in investment securities

Management of Insider Information as well as Timely and Fair Disclosure

The MIRAIT ONE Group discloses accurate information in a timely manner through TDnet and EDINET in accordance with the Disclosure Policy published separately. We also make use of mediums such as our corporate website and press releases, actively working to further broaden our information dissemination. Furthermore, The MIRAIT ONE Group strives to provide beneficial information that is easy for shareholders and other investors to understand, such as materials used in its IR activities.

In our dealings with all shareholders and other investors, we will fully and properly manage information in accordance with “Rules on insider trading regulations” when we are in possession of material information that has not yet been disclosed to the public.

Efforts to Enhance Communication

The IR Department undertakes investor relations activities as the department in charge of investor relations under the supervision of the Director and Chief of Finance and Accounting Division, who is the manager responsible for the handling of information. The managers responsible for investor relations handle consultations with all of our shareholders and other investors as much as possible.

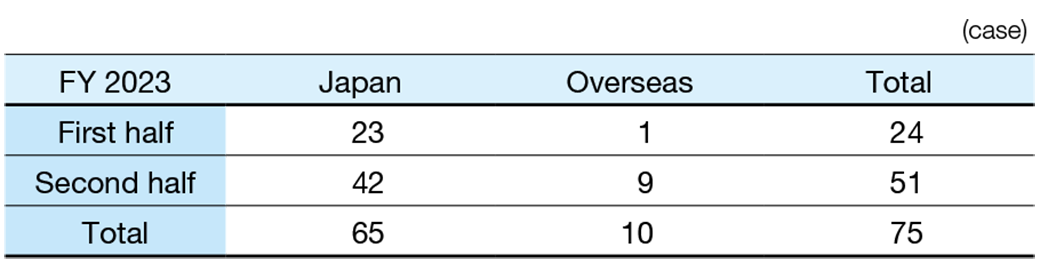

Individual consultations*

*Excluding inquiries by phone and email

*Excluding inquiries by phone and emailConsultations were held with analysts (sell-side and buy-side), fund managers, and others.

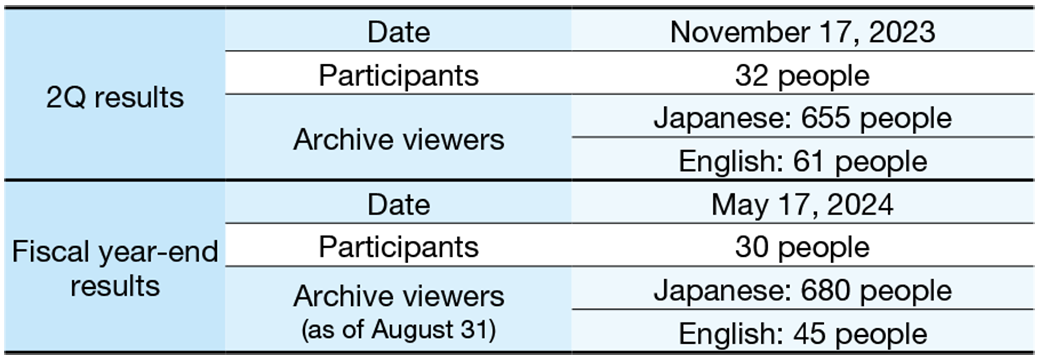

The MIRAIT Group holds financial results briefings twice a year for analysts and institutional investors and distributes the briefings on its website, etc. In addition to providing important information in English in a timely manner to overseas institutional investors, we also engage in overseas IR activities in the North American, European and Asian regions. Our representatives also work to explain matters fully at these financial results briefings and in our overseas IR activities to encourage constructive dialogue with all of our shareholders and other investors.

Financial Results Briefing for Analysts

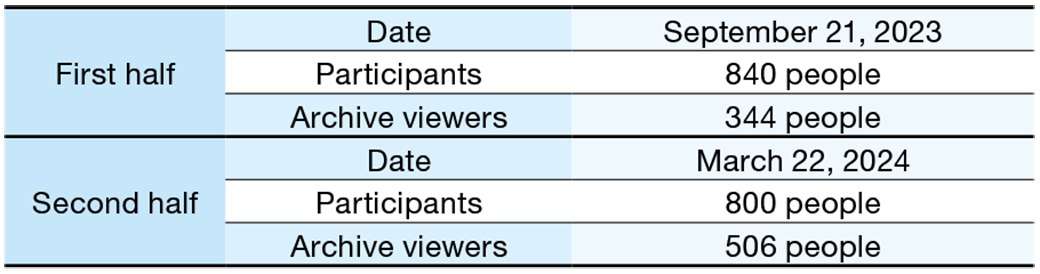

In addition, in order to help people deepen their understanding of our business, we participate in online company information sessions streamed live for individual investors, as well as individual investor information sessions held by securities companies as appropriate.

Briefing for Individual Investors

The opinions of shareholders and investors are provided as feedback to management at meetings of the Board of Directors and the Group Presidents’ Council. Furthermore, the Group also sends MIRAIT Report booklets that include business performance and topics to all of the shareholders twice a year.

* For details of dialogue with shareholders and investors, see the Company’s website.

Status of measures to facilitate the operation of the General Meeting of Shareholders, and the exercise of voting rights

With regard to the conduct of general meetings of shareholders, we are making efforts to facilitate the understanding of shareholders by, for example, printing the convocation notice in color and incorporating video presentations into the delivery of business reports. The convocation notice, reference documents, and reports are also available on the Company’s website.

The notice for the 14th Annual General Meeting of Shareholders, scheduled for June 25, 2024, was sent on June 7, 2024, 18 days prior to the meeting (the legal date is June 10, 2024). On June May 31, 2024, (25 days prior to the General Meeting of Shareholders), the Company initiated electronic delivery measures on the Tokyo Stock Exchange and the Company's website (the legal date was June 4). This was done to ensure that shareholders had sufficient time and access to information to exercise their voting rights. At the general meeting venue, we made environmental arrangements in consideration of the Act for Eliminating Discrimination against Persons with Disabilities (Disability Discrimination Elimination Act), such as setting up designated wheelchair areas.

In order to deepen the understanding of shareholders and others who were unable to attend the meeting, the business report was posted in video format on the Company’s website in advance, and the meeting was streamed live on the day of the meeting. The video of the meeting is also made available after the meeting for shareholders who were unable to view the live stream.

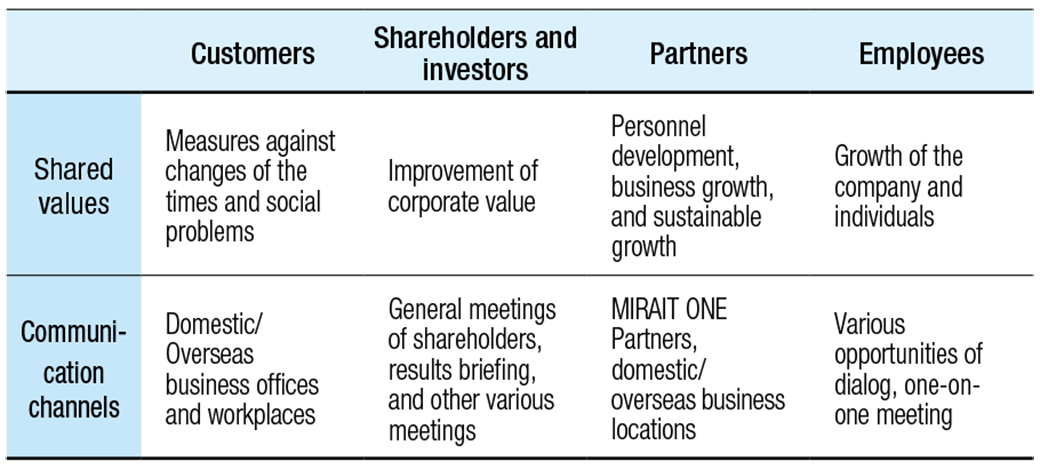

Dialogue with stakeholders

In the current phase of accelerating growth in MIRAI (future) domains such as “urban and regional development/Corporate DX and GX” businesses and global businesses, our customer base is expanding from conventional telecommunication carriers to local governments and private enterprises, and collaboration partners are also increasing due to the integration of Seibu Construction Co., Ltd. and Kokusai Kogyo Co., Ltd. So, the Group are strengthening stakeholder engagement mainly in efforts toward the Purpose (meaning of existence) and Mission (public mission), which defines the Group stance toward different stakeholders (→ see pages 6 “Purpose,” “Mission,” and “Stakeholders in view”).

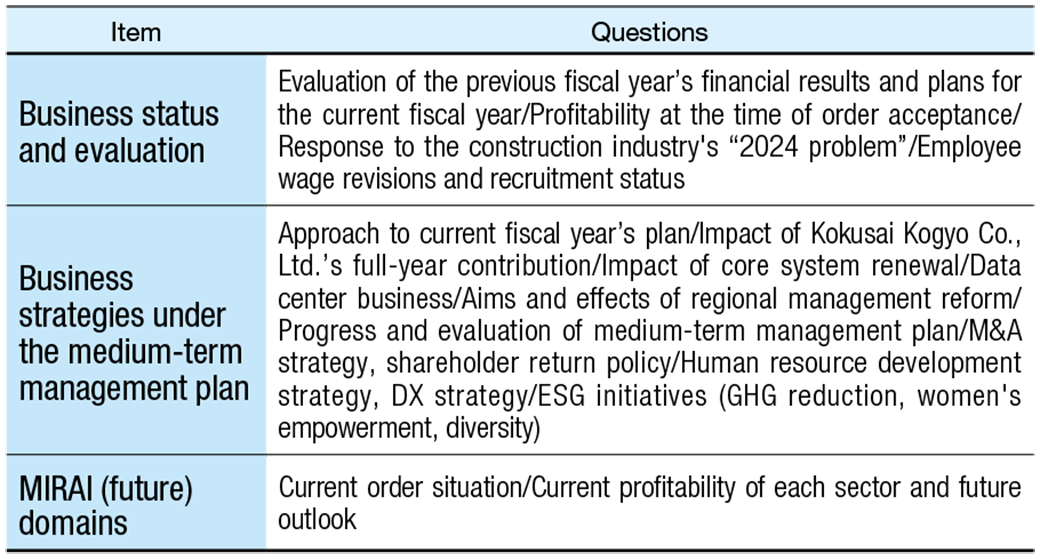

Major interests raised in dialog with shareholders and investors Listed below are major opinions and questions that we received in dialogue with shareholders and investors. They are fed back to the management personnel for the improvement of management and the strengthening of engagement.

* For details of dialogue with shareholders and investors, see the Company’s website.

* For details of dialogue with shareholders and investors, see the Company’s website.