Information disclosure based on TCFD proposal

Information disclosure based on TCFD proposal

In October 2021, the MIRAIT ONE Group joined the TCFD Consortium*2, endorsing the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)*1, which aims to proactively disclose the financial impact of climate-related risks and opportunities. In May 2022, we disclosed information based on the recommendations on "Governance," "Risk Management," "Strategy (Scenario)," "Target," and "Actual Performance" as described in the section below. In the future, we will monitor changes in the external and internal environment associated with climate change with respect to "identified risks" and "opportunity examination." We will also work to expand the scope of disclosure further to include the development of risk management system, continued review of risks and opportunities based on scenario analysis, etc. and progress toward achieving the greenhouse gas emissions reduction targets.

-

*1 Established by the Financial Stability Board to facilitate more informed decision making on investments, credit, and insurance underwriting, help stakeholders better understand the concentration of carbon-related assets in finance, and formulate recommendations for more effective climate-related disclosures.

*1 Established by the Financial Stability Board to facilitate more informed decision making on investments, credit, and insurance underwriting, help stakeholders better understand the concentration of carbon-related assets in finance, and formulate recommendations for more effective climate-related disclosures.

-

*2 An organization established as a forum for companies, financial institutions, etc. that endorse the TCFD, working together to discuss effective information disclosure by companies and initiatives to help financial institutions make appropriate investment decisions based on disclosed information.

*2 An organization established as a forum for companies, financial institutions, etc. that endorse the TCFD, working together to discuss effective information disclosure by companies and initiatives to help financial institutions make appropriate investment decisions based on disclosed information.

Governance

After establishing ESG Management Promotion Committee (see ESG Management Promotion System) in September, the materiality "Create and protect an environmentally friendly society" was resolved after deliberation by the Management Committee and the Board of Directors, and the realization of a decarbonized society In order to make full-fledged contributions to this goal, we have set a greenhouse gas emissions reduction target (2030), which is one of the KPIs in our medium-term management plan, and have established a system to monitor progress.

The 2030 greenhouse gas emissions reduction target was certified as SBT (Science Based Targets*1) in February 2023.

In fiscal 2024, the committee will meet six times in total to discuss the specific GHG emissions reduction status and reduction measures for the entire group, respond to evaluations from various ESG rating agencies, analyze the results, formulate strategies, We are promoting various measures.

*1 Greenhouse gas reduction targets set by companies with a target year of 5 to 15 years in the future consistent with the level required under the Paris Agreement (limiting global warming to well-below 2°C above pre-industrial levels and pursuing efforts to limit warming to 1.5°C). (From the Ministry of the Environment and Ministry of Economy, Trade and Industry Green Value Chain Platform)

We also revised the remuneration system for board members to raise the awareness of management on ESG initiatives. In FY 2022, a non-financial target of “greenhouse gas emissions” was introduced as a new indicator in addition to the conventional indicators for performance-linked compensation: “consolidated operating profit” and “consolidated ROE.”

Risk Management

We have established a basic policy and promotion system for risk management as a corporate group in the form of “Risk Management Regulations,” as we take appropriate steps to deal with various risks based on our risk management plan. (Related section: Thorough risk management.)

The ESG Management Promotion Committee also takes the initiative on climate-related risks and opportunities, monitoring changes in the external and internal environment associated with climate change and identifying climate risks and opportunities that affect our business. The identified risks and opportunities are evaluated and analyzed to determine their impact on the Group with a focus on risks and opportunities that have a high degree of impact. Following deliberations by the Board of Directors and the Executive Committee, these are incorporated as company-wide risks and opportunities.

Strategy

The MIRAIT ONE Group has analyzed the potential climate-related risks and opportunities in the future by referring to the scenarios based on the average temperature rise of less than 2°C (e.g. 1.5°C) and 4°C*1. Consequently, it was assessed that the transition to a decarbonized society (policy/legislation/market/reputation) would be subjected to the impacts that manifest as a result of anticipated future events and physical (acute/chronic) impacts from climate change.

We reviewed our medium-term management strategy with respect to these risks and reaffirmed the "realization of a decarbonized society through business activities" as a material issue. In terms of our business engagement, we have also identified the growing demand for smart infrastructure/energy solutions as a prospective opportunity.

*1 The scenarios refer to the following.

A scenario in which a decarbonized society is realized quickly:

• International Energy Agency (IEA) World Energy Outlook 2018 Sustainable Development Scenario (SDS)

• IEA Energy Technology Perspectives 2017 Beyond 2°C Scenario (B2DS)

A scenario in which the physical impact is manifested:

* Intergovernmental Panel on Climate Change (IPCC) Fifth Assessment Report

* An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty

Future where the target of less than 2°C (such as 1.5°C ) is achieved: A scenario for the rapid materialization of a decarbonizing society

| Envisioned scenario | Tighter carbon emission regulations | Increasing awareness toward decarbonization | |

| Identified risks | |||

| Duration until risk occurrence | Medium- and long-term | Short-, medium- and long-term | Short-term |

| Type | Policy/regulation | Policy/regulation | Market/reputation |

| Description |

・Increase in material and fuel procurement costs due to carbon taxation ・Increased business burden due to insufficient compliance with regulations such as carbon pricing ・Risk of cost increase due to the purchase of credits for emissions in case of failure to achieve reduction targets. |

・Increase in electricity costs due to a shift to renewable energy sources | ・ When environmental measures turn out to be inadequate - Decrease in orders for new construction projects - Termination of existing maintenance contracts - Loss of customers due to higher reputation risks |

| Opportunity examination | |||

| Duration until risk occurrence | Medium- and long-term | Short-, medium- and long-term | Short-term |

| Type | Product/service/energy | Product/service/energy | Market |

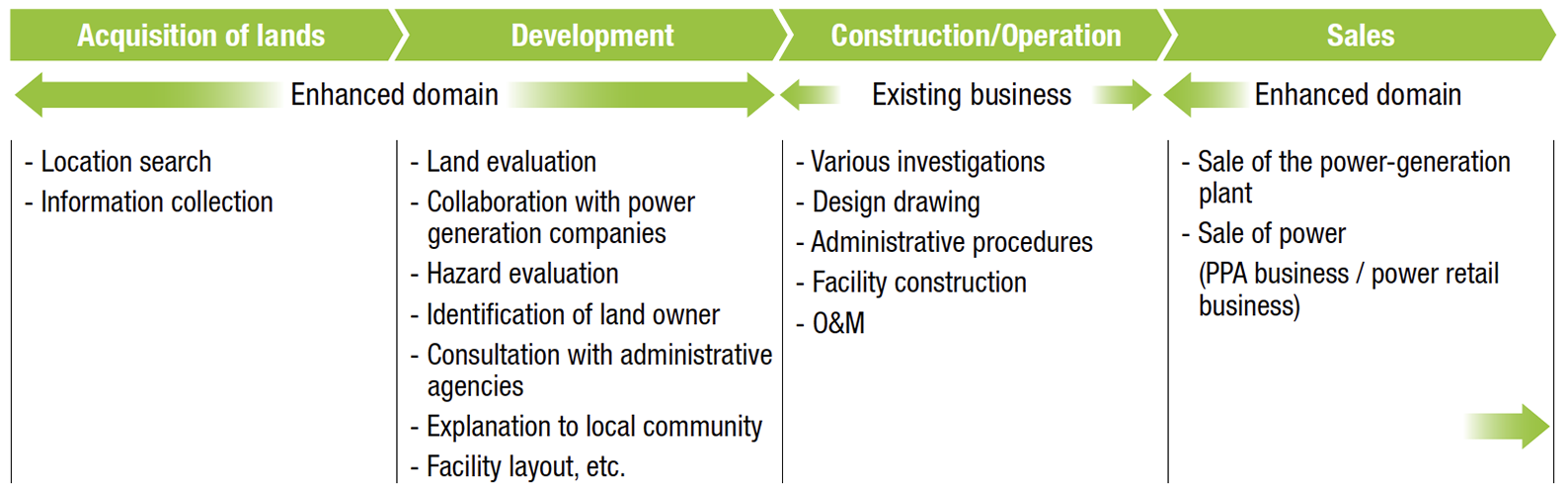

| Description | ・Increase in demand for renewable energy and energy-saving projects (solar power generation, EV charging, LED lighting, etc.) | ・Increase in demand for shift to energy-saving equipment ・Promotion of the efficient electricity use with the use of IoT |

・Increase in demand for renovation work ・Increase in demand for ZEB and smart city-related projects |

| Initiatives | |||

| Details | ・Promotion of power-saving through DX and work-style reform. ・Improvement in fuel efficiency through the use of fuel additives for vehicles, and promotion of EV adoption. ・Promotion of renewable energy utilization in purchased electricity. |

・Identifying and promoting the procurement of low-carbon products. ・Proper disclosure of information to stakeholders. |

|

Future where average temperatures rise by 4°C: A scenario characterized by the manifestation of physical impact

| Envisioned scenario | Increase in the frequency and severity of natural disasters | Rise in average temperatures | ||

| Identified risks | ||||

| Duration until risk occurrence | Short-, medium- and long-term | Short-, medium- and long-term | Long-term | Medium- and long-term |

| Type | Acute | Acute | Chronic | Chronic |

| Description | ・Damage to telecommunication equipment and base stations caused by heavy rains and typhoons and increase in restoration costs ・Decrease in workforce due to disaster. |

・Discontinuation of products and services due to disruption of the value chain | ・Increase in air conditioning costs incurred by data centers, etc. | ・Decrease in labor productivity and increase in health issues such as heat stroke due to deterioration of outdoor working environment. |

| Opportunity examination | ||||

| Duration until risk occurrence | Short-, medium- and long-term | Medium- and long-term | Long-term | Medium- and long-term |

| Type | Market/resilience | Market | Market | Resilience |

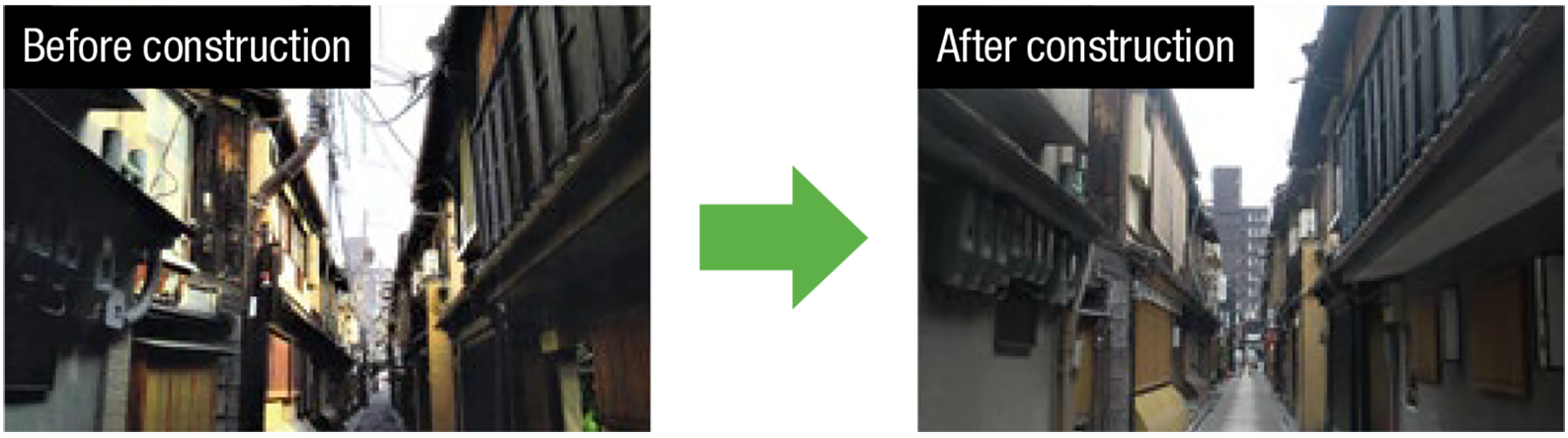

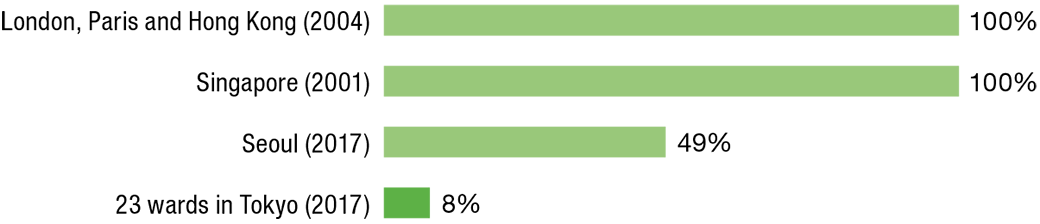

| Description | ・Increase in demand for pole-free electricity to deal with abnormal weather conditions | ・Growing demand for disaster prevention and mitigation work for telecommunication equipment and base stations due to the increase in the frequency and severity of natural disasters | ・Replacement of air conditioning equipment with high-efficiency equipment ・Improvement of the operation of HVAC equipment |

・Further promotion of DX and remote working style |

| Initiatives | ||||

| Details | ・Increase in demand for facility enhancements such as battery storage systems and emergency power supply. ・Development of multi-skilled human resources. ・Enhancement of collaboration with MIRAIT ONE Partners*1. |

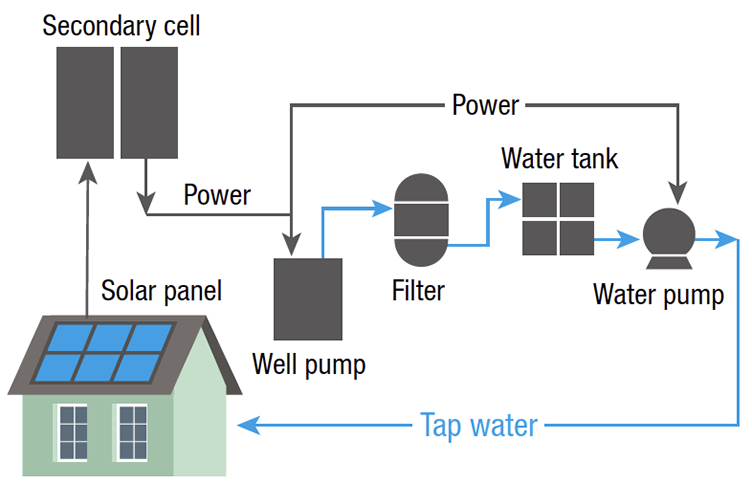

・Water supply solution business. | ・strengthening of air conditioning business. | ・Streamlining construction through DX and strengthening worker health management. |

*1 Collaboration with partner companies is a core theme of ESG management foundation. We have launched the "MIRAIT ONE Partners" with approximately 350 core companies out of the 2,200 cooperating companies and partner companies within the Mirait One Group.(July 2022)

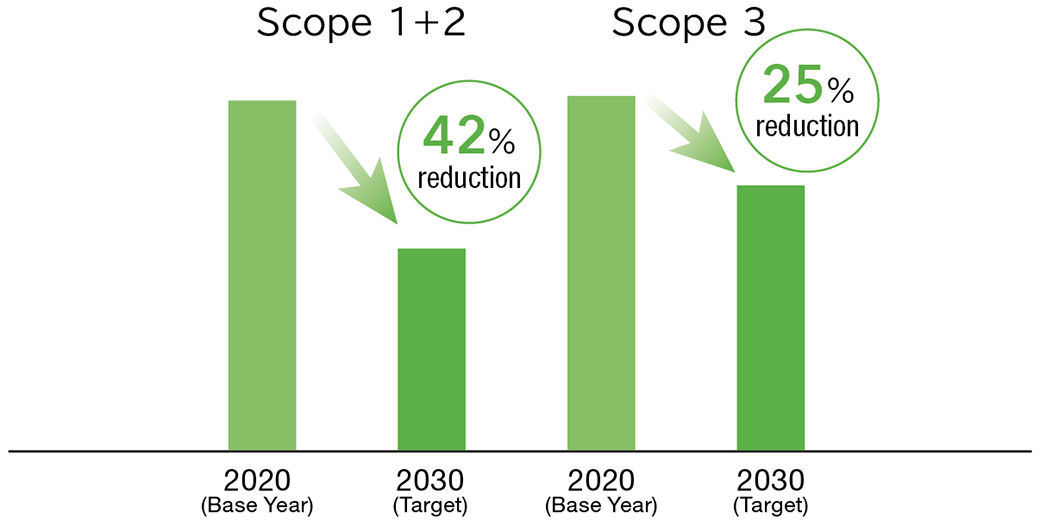

Target

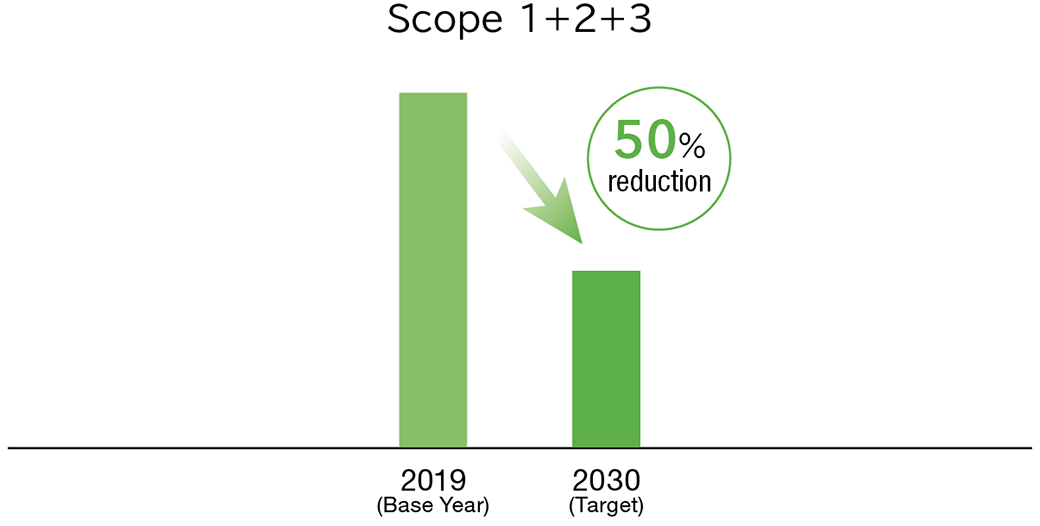

In FY2021, the MIRAIT One Group (excluding Kokusai Kogyo) declared its commitment to “Realization of virtually zero greenhouse gas (GHG) emissions by 2050” in order to achieve carbon neutrality by 2050, and set a target for reducing greenhouse gas emissions in fiscal 2030. In February 2023, we were certified by SBTi(Science Based Targets initiative) as a scientifically based target. By setting non-financial targets in the medium-term management plan, we are steadily incorporating growth opportunities for our business in decarbonisation.

Kokusai Kogyo set a reduction target and obtained SBT certification in September 2021, before joining the Group, and in March 2025, it set a new net-zero Long-Term target and obtained SBT certification. At the same time, the Near-Term target was reviewed and revised to a more aggressive target, and SBT accreditation was obtained.

- Achieve virtually zero greenhouse gas (GHG) emissions by 2050

- Greenhouse gas emissions reduction targets toward FY 2030

MIRAIT One Group (excluding Kokusai Kogyo)

| Target | SBT | |

|---|---|---|

| Scope 1+2 | Reduce the Group's greenhouse gas emissions by 42% from the FY2020 (base year) level by FY2030. | Certified in February 2023 |

| Scope 3 | Reduce the Group's greenhouse gas emissions by 25% from the FY2020 (base year) level by FY2030 *Our policy is to promote emission reductions primarily through the purchased products/services and the use of products sold. | Certified in February 2023 |

(Listed separately) Kokusai Kogyo Corporation

SBT Near-Term Targets In accordance with the renewal certification of SBT Near-Term Targets and Long-Term Targets in March 2025, the targets have been changed from the previous targets to the following targets, including the scope of coverage.

| Overall Net-Zero Target | |

|---|---|

| Kokusai Kogyo Co., Ltd. commits to reach net-zero greenhouse gasemissions across the value chain by FY2050. | DATE OF APPROVAL 24 March 2025 |

| Near-Term Target | SBT | |

|---|---|---|

| Scope 1+2 | Kokusai Kogyo Co., Ltd. commits to reduce absolute scope 1 and 2GHG emissions 70% by FY2030 from a FY2019 base year. | DATE OF APPROVAL 24 March 2025 |

| Scope 3 | Kokusai Kogyo Co., Ltd. alsocommits to reduce absolute scope 3 GHG emissions from fuel- and energy-related activities,business travel, employee commuting and use of sold products 50% within the sametimeframe. Kokusai Kogyo Co., Ltd. further commits that 65% of its suppliers byemissionscovering purchased goods and services and capital goods, will have science-based targetsby FY2026. | DATE OF APPROVAL 24 March 2025 |

| Long-Term Target | SBT | |

|---|---|---|

| Scope 1+2 | Kokusai Kogyo Co., Ltd. commits to reduce absolute scope 1 and 2GHG emissions 90% by FY2050 from a FY2019 base year. | DATE OF APPROVAL 24 March 2025 |

| Scope 3 | Kokusai Kogyo Co., Ltd. alsocommits to reduce absolute scope 3 GHG emissions 90% within the same timeframe. | DATE OF APPROVAL 24 March 2025 |

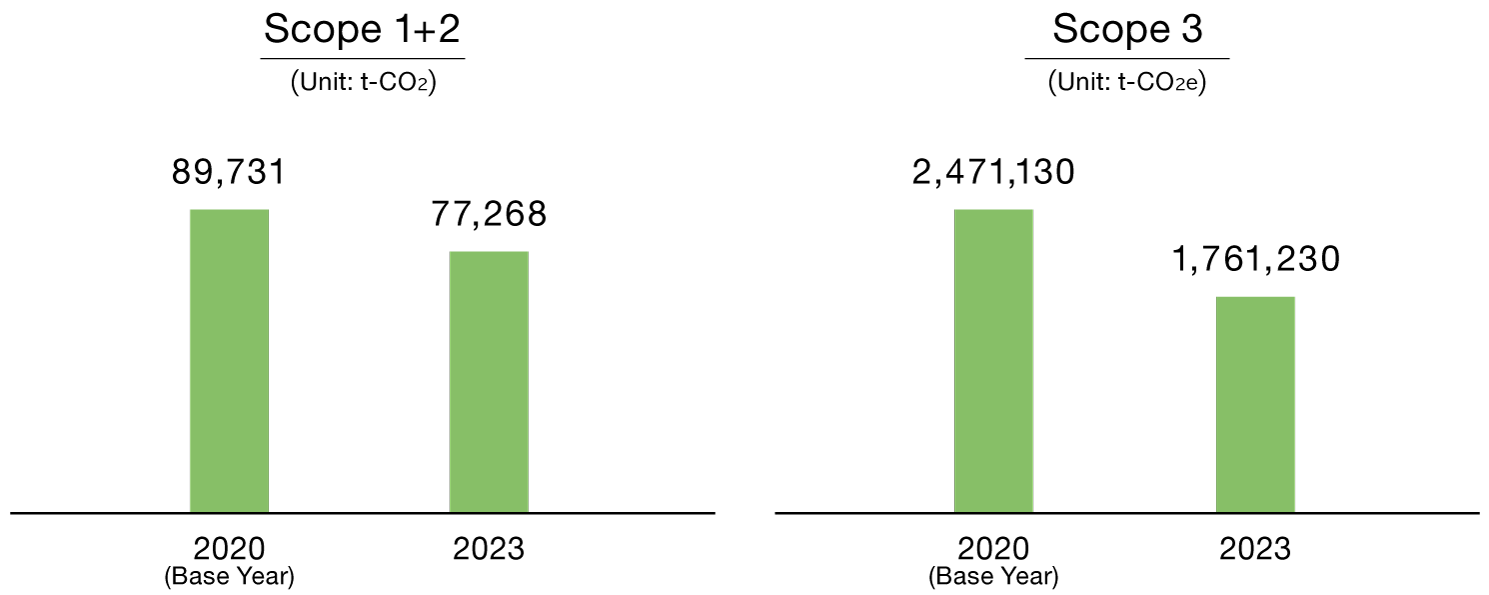

Actual results

The results of greenhouse gas emissions for fiscal 2020 and subsequent years are as follows.

Reduction of greenhouse gas emissions

Independent assurance statement for fiscal year 2024 (Scope1,2)(PDF:1,500KB)

(For past independent assurance statements, click here.)

MIRAIT One Group as a whole

| Category | Emissions | ||

|---|---|---|---|

| FY 2020 (Standard) | FY 2023 | FY 2024 | |

| Scope 1+2 | 89,731(t-CO2) | 77,268(t-CO2) | 69,050(t-CO2) |

| Scope 3 | 2,471,130(t-CO2e) | 1,761,230(t-CO2e) | under calculation (Publicly scheduled for September) |

※The actual greenhouse gas emissions for the entire Group in FY2023 and beyond include the results of Kokusai Kogyo.

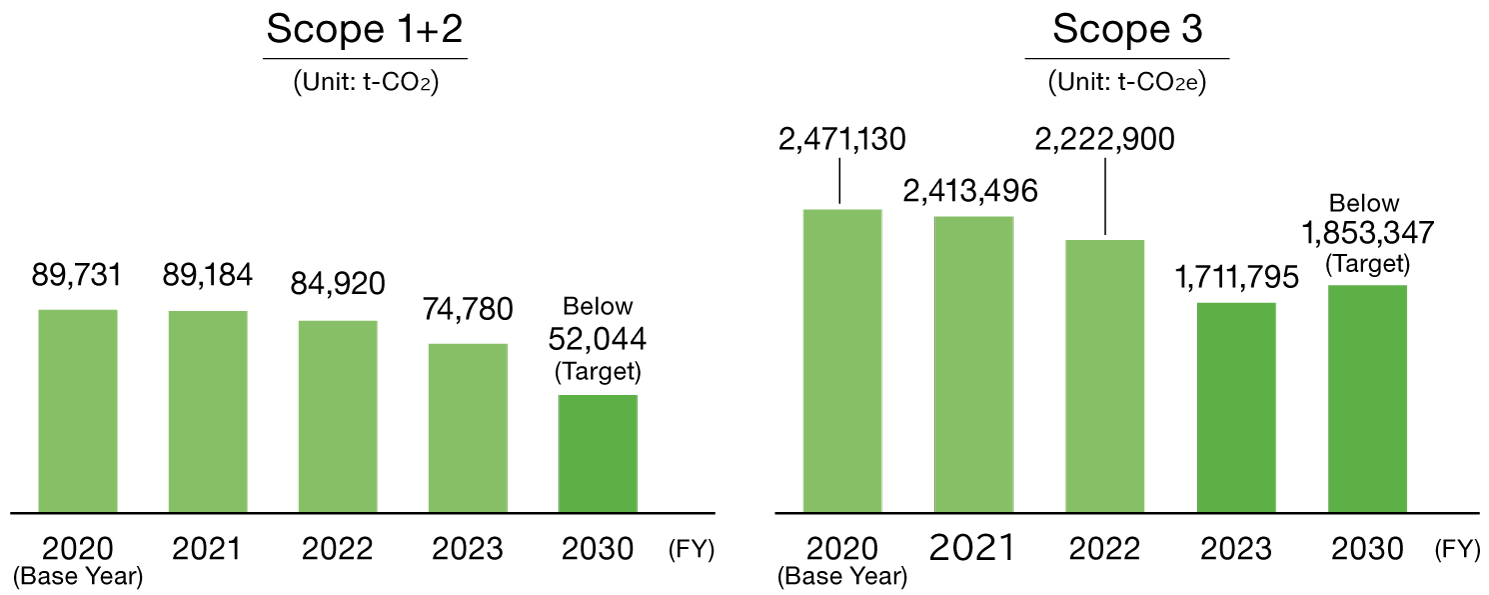

MIRAIT One Group (excluding Kokusai Kogyo)

| Category | Emissions | |||||

|---|---|---|---|---|---|---|

| FY2020 (Standard) |

FY 2021 | FY 2022 | FY 2023 | FY 2024 | ||

| Scope 1 |

Direct emissions | 66,890 | 67,907 | 65,166 | 61,811 | 58,073 |

| Scope 2 |

Indirect emissions | 22,841 | 21,277 | 19,754 | 12,969 | 8,935 |

| Scope 3 |

Other indirect emissions | 2,471,130 | 2,413,496 | 2,222,900 | 1,711,795 | under calculation (Publicly scheduled for September) |

| Category 1 | Purchased goods and services | 513,292 | 452,295 | 337,073 | 362,896 | |

| Category 11 | Use of sold products | 1,892,870 | 1,848,997 | 1,814,356 | 1,273,909 | |

| Others (Category2,3,5,6,7,12,13) Total | 64,968 | 112,204 | 71,471*1 | 74,990*1 | ||

| Sum total for Scope1ー3 | 2,560,861 | 2,502,680 | 2,307,820 | 1,786,575 | ||

*Figures for FY 2020 (Standard) include those for Seibu Construction Co., Ltd.

*Emission unit: Scope1,2 (t-CO2), Scope3 (t-CO2e)

*1 Appendix: Breakdown of Others

| Category | Emissions | ||

|---|---|---|---|

| FY 2022 Emissions(t-CO2e) |

FY 2023 Emissions(t-CO2e) |

||

| Category2 | Capital goods | 32,442 | 34,217 |

| Category3 | Fuel-and-energy-related activities (not included in Scope 1 or 2) |

13,165 | 12,763 |

| Category5 | Waste generated in operations | 3,362 | 3,268 |

| Category6 | Business travel | 1,866 | 2,208 |

| Category7 | Employee commuting | 3,392 | 4,015 |

| Category12 | End of life treatment of sold products | 3,163 | 4,105 |

| Category13 | Downstream leased assets | 14,081 | 14,413 |

*Category 4, 8, 9, 10, 14, 15 are not applicable to our company.

(Listed separately) Kokusai Kogyo Corporation

| Category | Emissions (t-CO2) | |||

|---|---|---|---|---|

| FY2019 (Base Year) |

FY2023 | FY2024 | ||

| Scope 1 | Direct emissions | 1,456 (t-CO2) |

1,202 (t-CO2) |

1,189 (t-CO2) |

| Scope 2 | Indirect emissions | 3,767 (t-CO2) |

1,285 (t-CO2) |

853 (t-CO2) |

| Scope 3 | Other indirect emissions |

66,303 (t-CO2e) |

49,435 (t-CO2e) |

under calculation (Publicly scheduled for September) |

※Scope1,2 FY2023 emissions include actual annual greenhouse gas emissions of Kokusai Kogyo before joining the Group (prior to December 2023).